PPT Chapter 9 PowerPoint Presentation, free download ID3131483

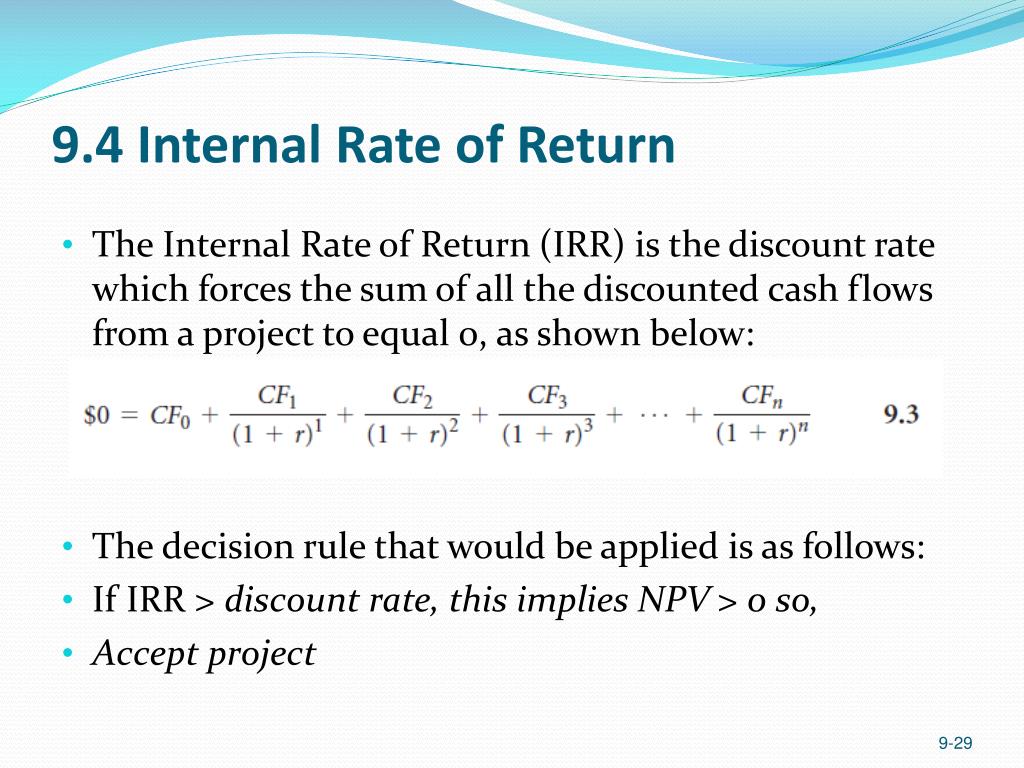

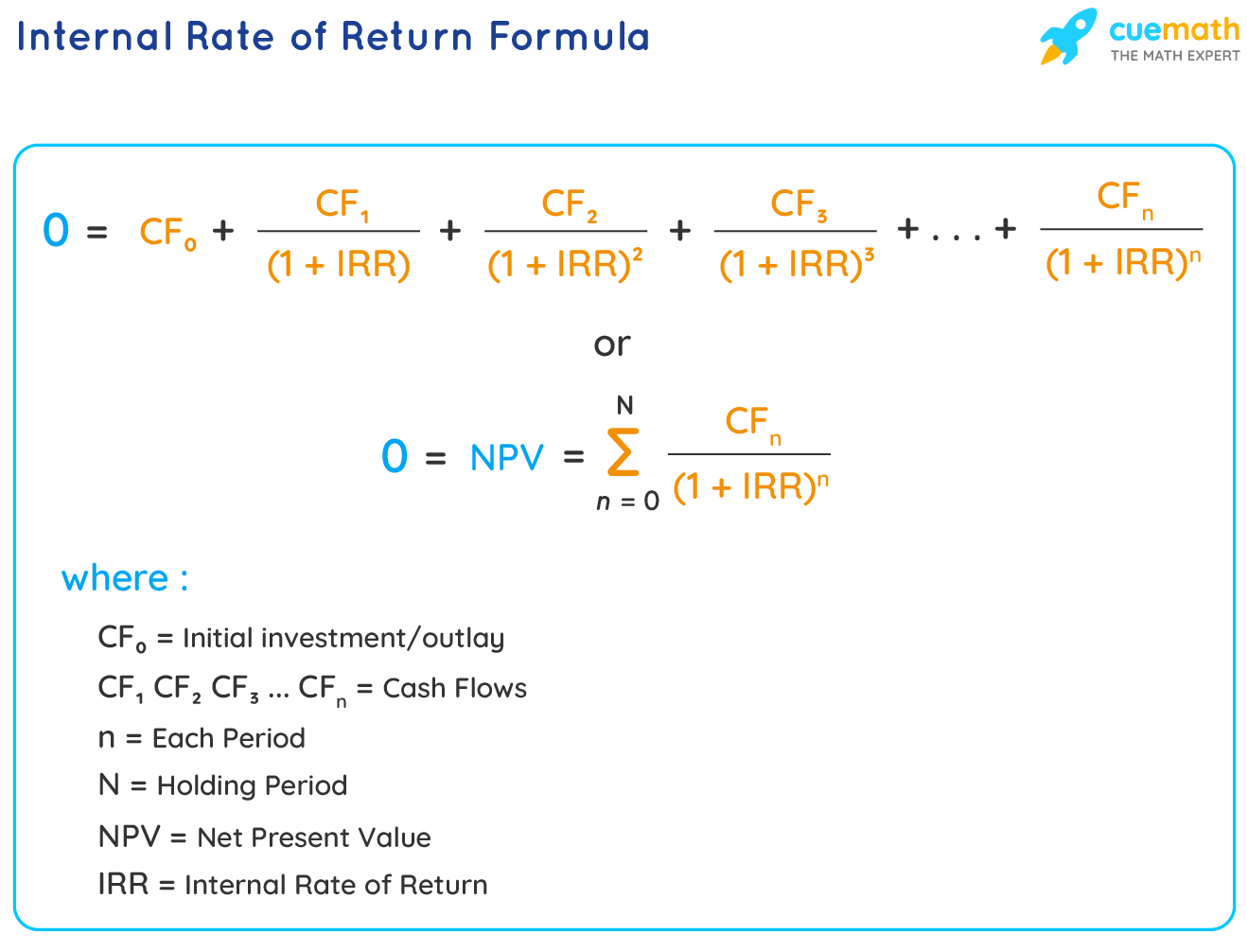

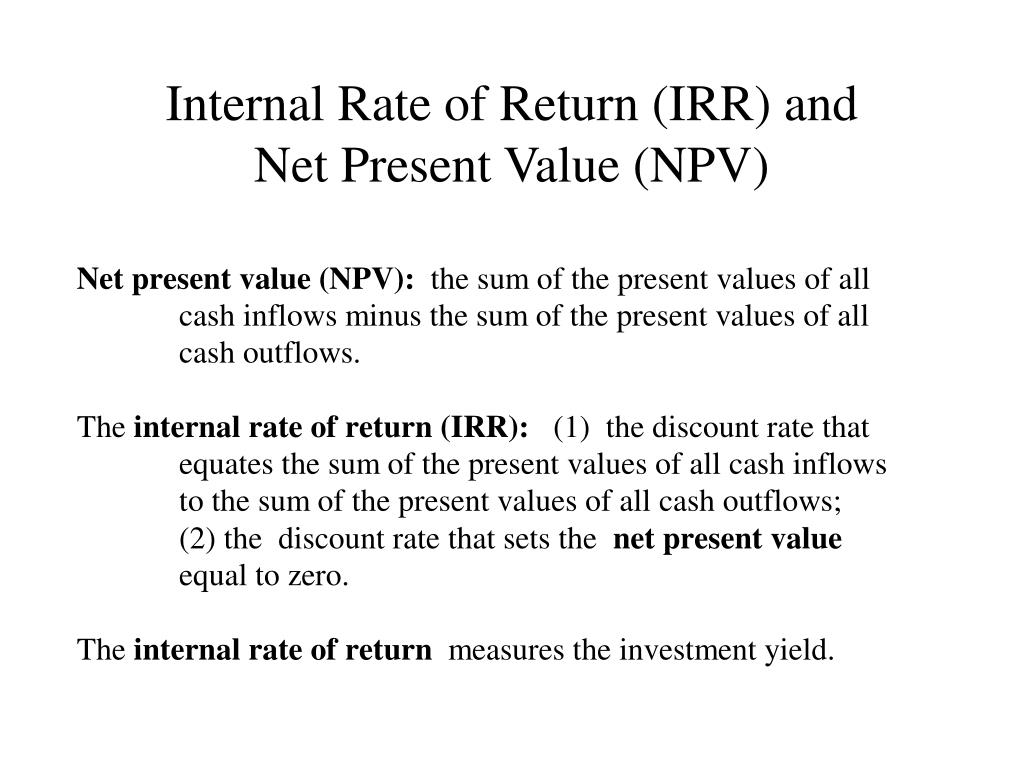

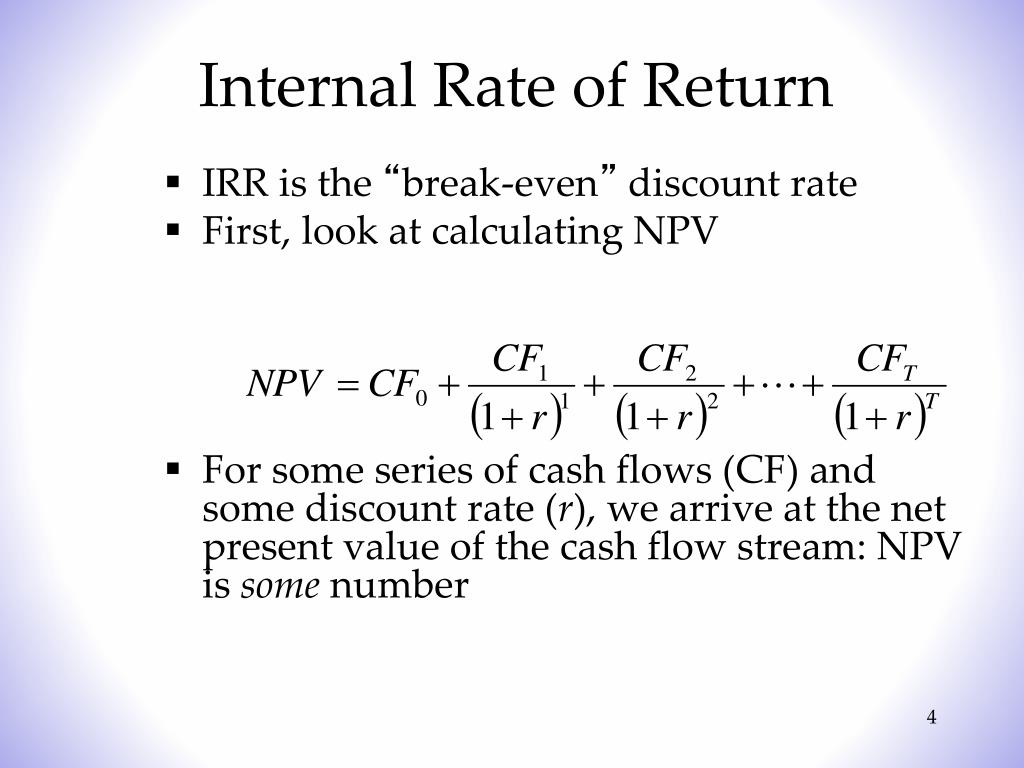

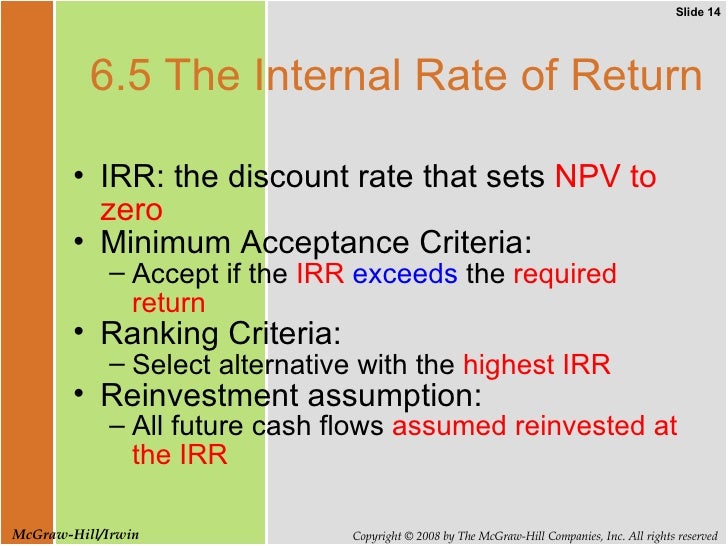

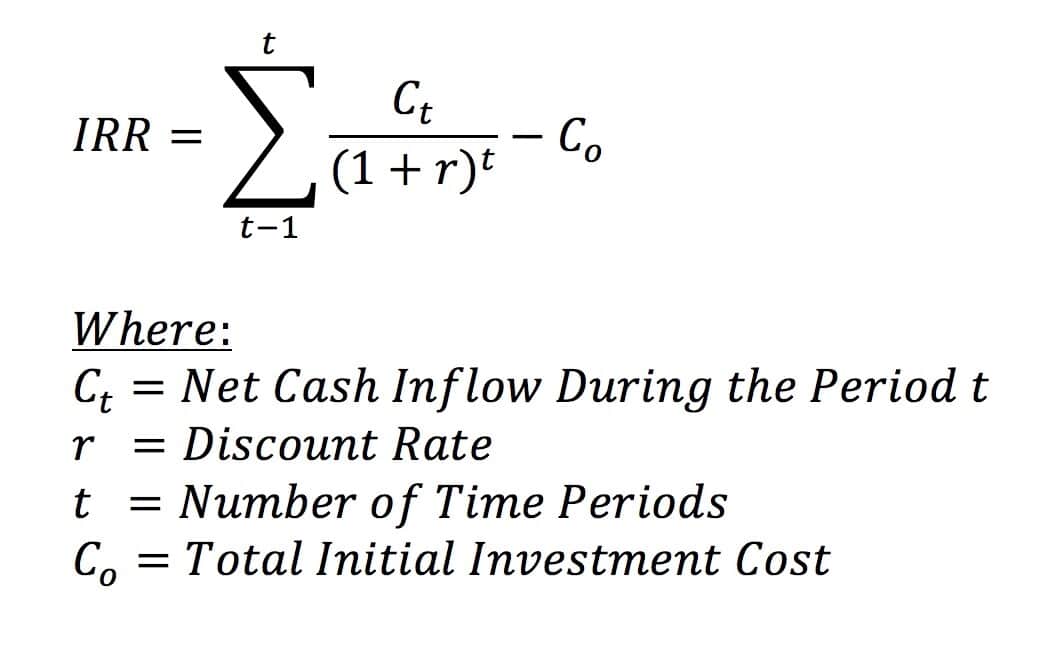

The Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of a project zero. In other words, it is the expected compound annual rate of return that will be earned on a project or investment. When calculating IRR, expected cash flows for a project or investment are given and the NPV equals zero. Put another.

Internal rate of return (irr) business diagram

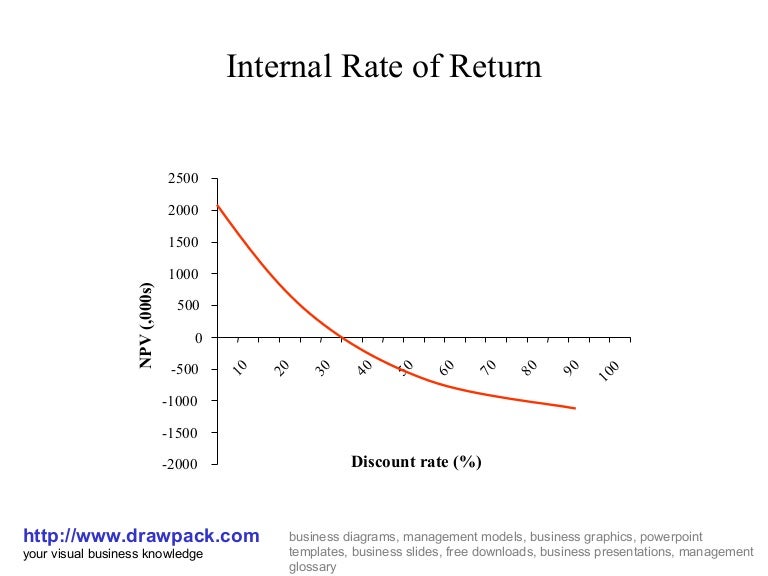

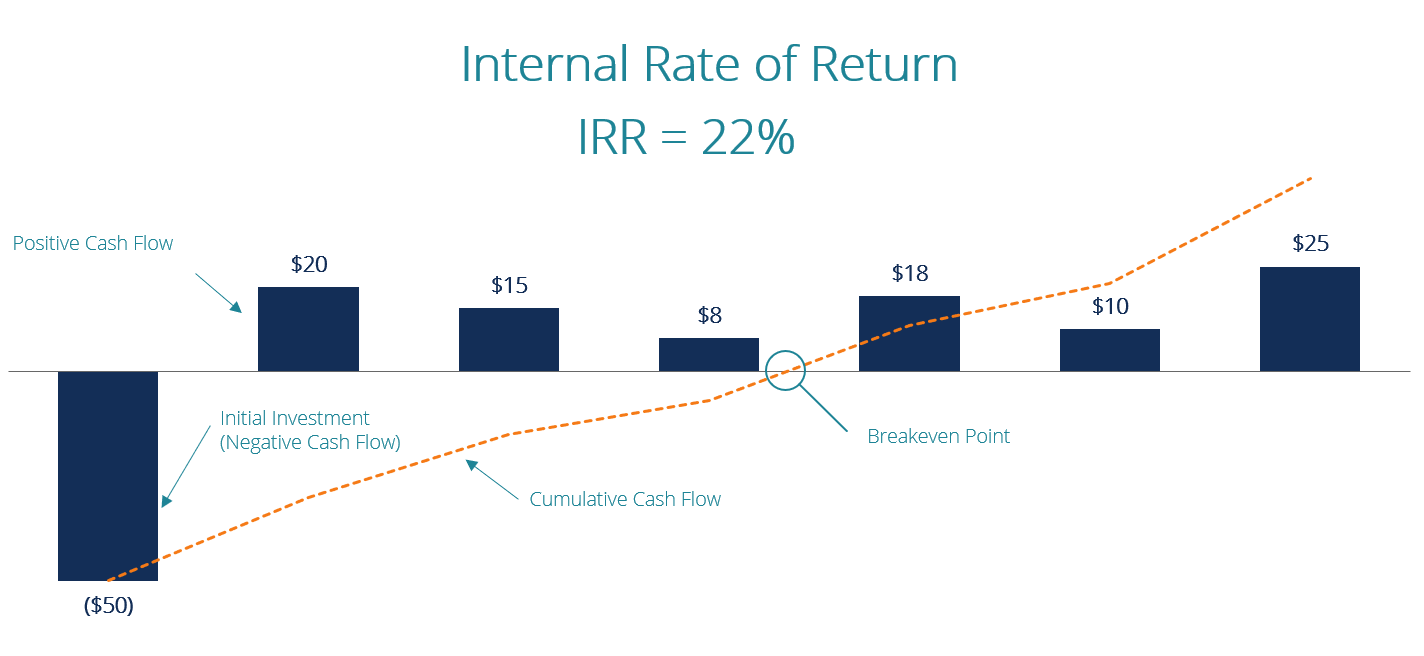

The internal rate of return is used to evaluate projects or investments. The IRR estimates a project's breakeven discount rate (or rate of return) which indicates the project's potential for profitability. Based on IRR, a company will decide to either accept or reject a project. If the IRR of a new project exceeds a company's required.

Internal rate of return (IRR) What is, calculation and examples

IRR - Exit Year 5 = 19.8%. If we were to calculate the IRR using a calculator, the formula would take the future value ($210 million) and divide by the present value (-$85 million) and raise it to the inverse number of periods (1 ÷ 5 Years), and then subtract out one - which again gets us 19.8% for the Year 5 internal rate of return (IRR).

Internal Rate of Return Formula Derivations, Formula, Examples

After subtracting the initial investment, the net present value of the project is $545.09, suggesting this is a good investment at the current discount rate. The internal rate of return is the discount rate that would bring this project to breakeven, or $0 NPV. In this case, an internal rate of return of 18.95% brings the net present value of.

Internal Rate of Return (IRR) How to use the IRR Formula

Internal rate of return: Understanding this metric and how to calculate it can help you invest more wisely Written by Aly J. Yale 2022-07-22T20:00:52Z

PPT Internal Rate of Return (IRR) and Net Present Value (NPV) PowerPoint Presentation ID4131732

The internal rate of return (IRR) rule is a guideline for evaluating whether a project or investment is worth pursuing. more Pooled Internal Rate of Return: Meaning, Formula, Limitations

PPT Internal Rate of Return (IRR) PowerPoint Presentation, free download ID2528370

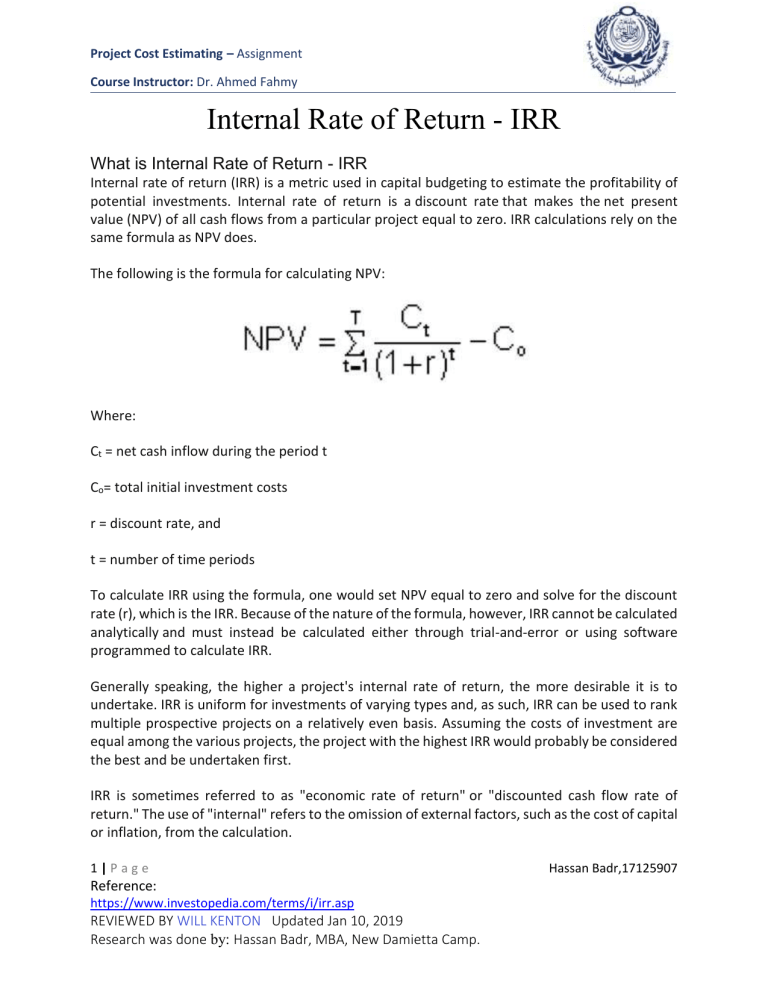

The Internal Rate of Return (IRR) is a financial metric often used in capital budgeting and corporate finance, representing the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. Essentially, it's the estimated compound annual growth rate that an investment is expected to generate.

Internal Rate of Return IRR

internal-rate-of-return (IRR) calculations as one measure of a project's yield. Private-equity firms and oil and gas companies, among others, commonly use it as a shorthand benchmark to compare the relative attractiveness of diverse investments. Projects with the highest IRRs are considered the most attractive and are given

PPT Engineering Economics Internal Rate of Return (IRR) and Other Metrics PowerPoint

Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount.

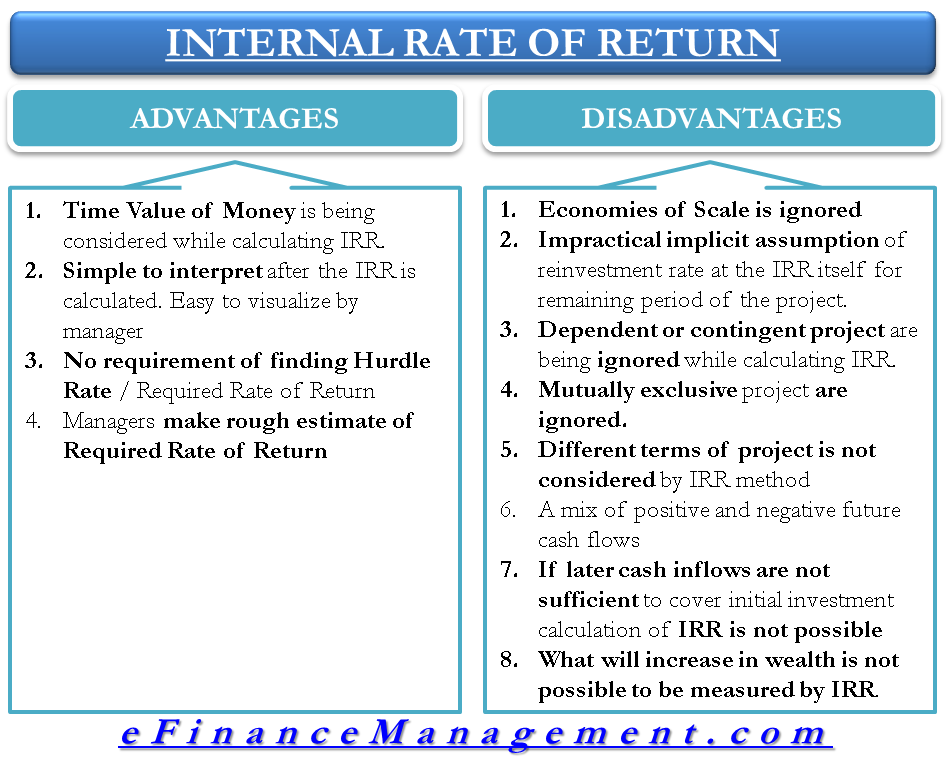

😀 Advantages of internal rate of return. Advantages and Disadvantages of Internal Rate of Return

The formula for calculating ROI is: ROI = [ (Expected amount - initial amount)/initial amount] * 100. For example, an initial investment of $1,000 that is currently worth $1,400 has a ROI of 40%.

Internal Rate of Return Definition, Advantage, Disadvantage eFM

Internal rate of return is a capital budgeting calculation for deciding which projects or investments under consideration are investment-worthy and ranking them. IRR is the discount rate for which the net present value (NPV) equals zero (when time-adjusted future cash flows equal the initial investment). IRR is an annual rate of return metric.

Modified Internal Rate of Return Method (also known as ERR) A Numerical Problem YouTube

The IRR (or implied interest rate) on this loan annually is 4.8%. Because the stream of payments is equal and spaced at even intervals, an alternative approach is to discount these payments at a 4.

Internal Rate of Return (IRR) Definition, Formula, Calculation & Example Parsadi

De internal rate of return (IRR) berekenen we aan de hand van de volgende formule: 0=NCW= (T∑t=1 )*Ct / (1+IRR)-C0. Waarin: Ct= Kasstroom gedurende periode t. C0= Investeringskosten. IRR= Internal Rate of Return. t= Aantal periodes. In de formule wordt de NCW gelijkgesteld aan 0 om zo de disconteringsvoet, de internal rate of return, te bepalen.

ESSENTIAL theory for CIMA P2 Internal Rates of Return! YouTube

Improvements to business performance. The best private-equity managers create value by rigorously improving business performance: growing the business, improving its margins, and/or increasing its capital efficiency. 1," In the hypothetical investment, revenue growth and margin improvement generated additional earnings in years one and two, amounting to a compounded cash-flow return of $3.30.

Internal Rate Of Return Irr Ketahui Contoh Perhitungan Riset

Internal rate of return (IRR) is a method of calculating an investment's rate of return.The term internal refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk.. The method may be applied either ex-post or ex-ante.Applied ex-ante, the IRR is an estimate of a future annual rate of return.

PPT Internal Rate of Return PowerPoint Presentation, free download ID1613167

Key Takeaways. Return on investment (ROI) and internal rate of return (IRR) are performance measurements for investments or projects. ROI indicates total growth, start to finish, of an investment.